Boring Jobs Are Making Gen Z Rich.

Remember when your guidance counselor said you absolutely, positively needed to go to college to make something of yourself? Remember your parents pushing you toward law school, medical school, or at least some kind of respectable white-collar career?

Yeah, about that.

While millennials and boomers fled from what they considered “boring” careers, tax accounting, plumbing, HVAC, electrical work, welding, Gen Z is discovering something their predecessors completely missed: these abandoned professions are absolute goldmines. And the data? It’s shocking.

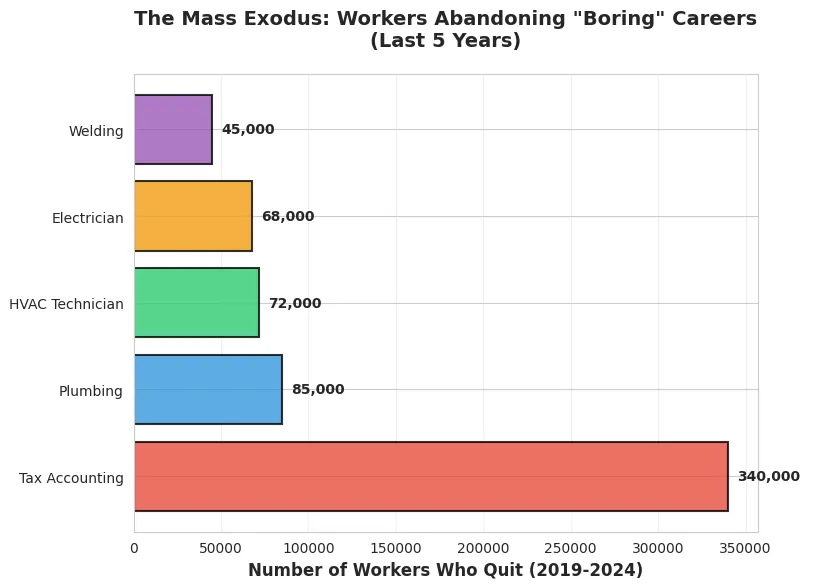

The Great Abandonment

Here’s a number that should make you sit up straight: 340,000 accountants quit in the last five years. Not switched firms. Quit the profession entirely.

And it gets better, or worse, depending on your perspective. Seventy-five percent of remaining accounting professionals are expected to retire in the next decade. That’s not a typo. Three-quarters of the entire field is about to vanish.

But Gen Z isn’t crying about it. They’re cashing checks.

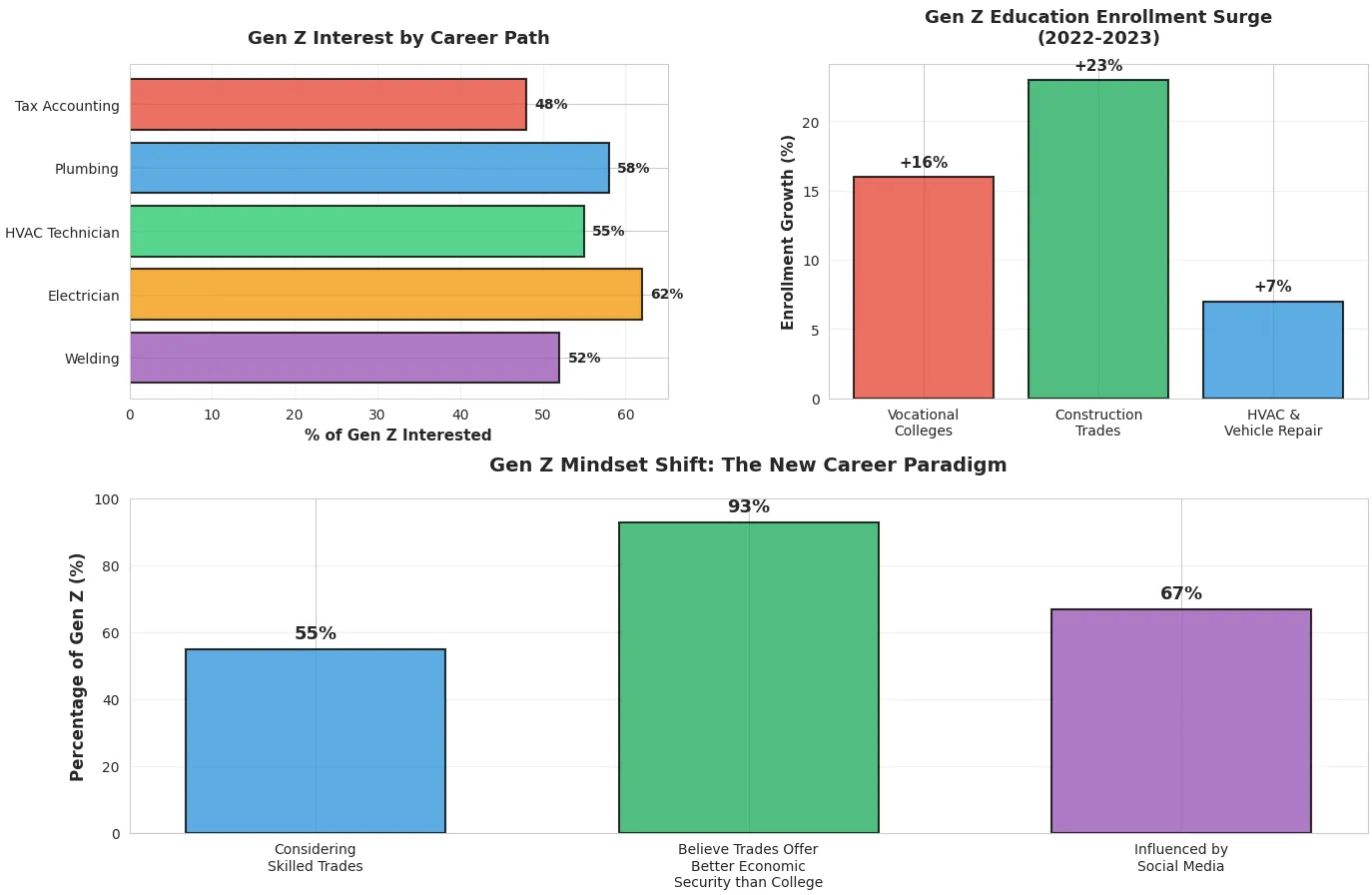

Vocational college enrollment surged 16% in 2023. Construction trade enrollment jumped 23% from 2022 to 2023. And here’s the kicker: 55% of Gen Z is now considering skilled trades careers, with 93% of recent grads believing trades offer better economic security than traditional college.

Let that sink in for a second. The generation everyone said was entitled and lazy is outworking everyone else by learning actual skills that pay actual money.

Let’s Talk Number

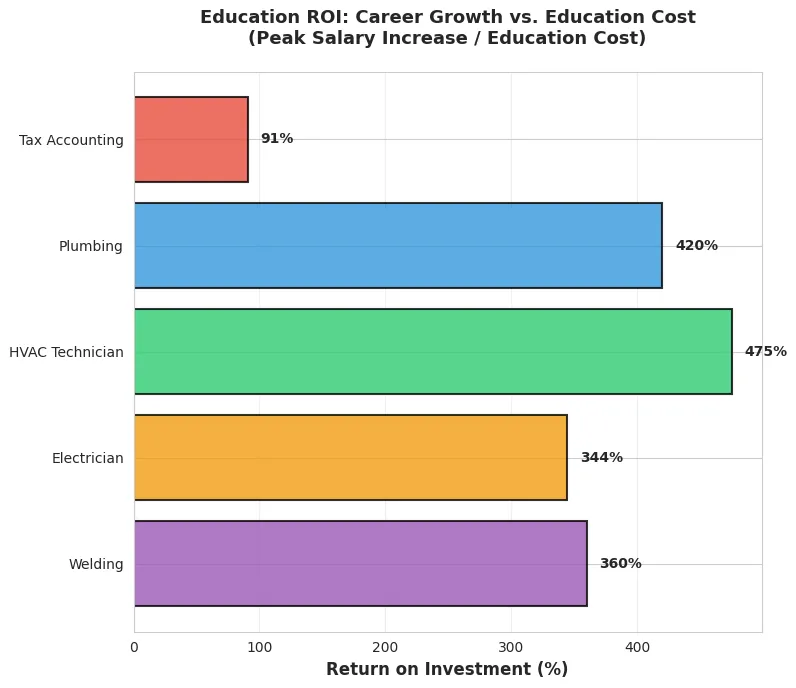

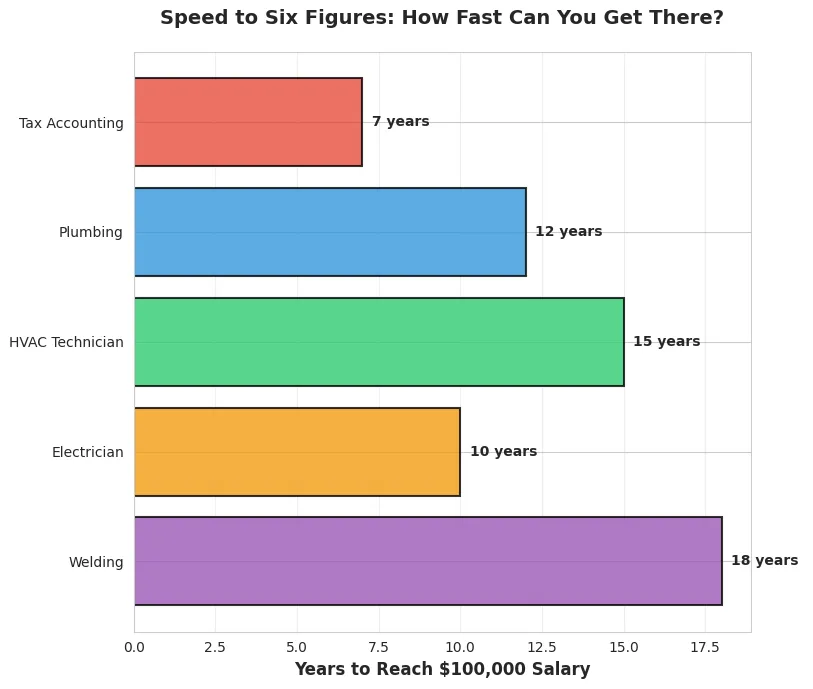

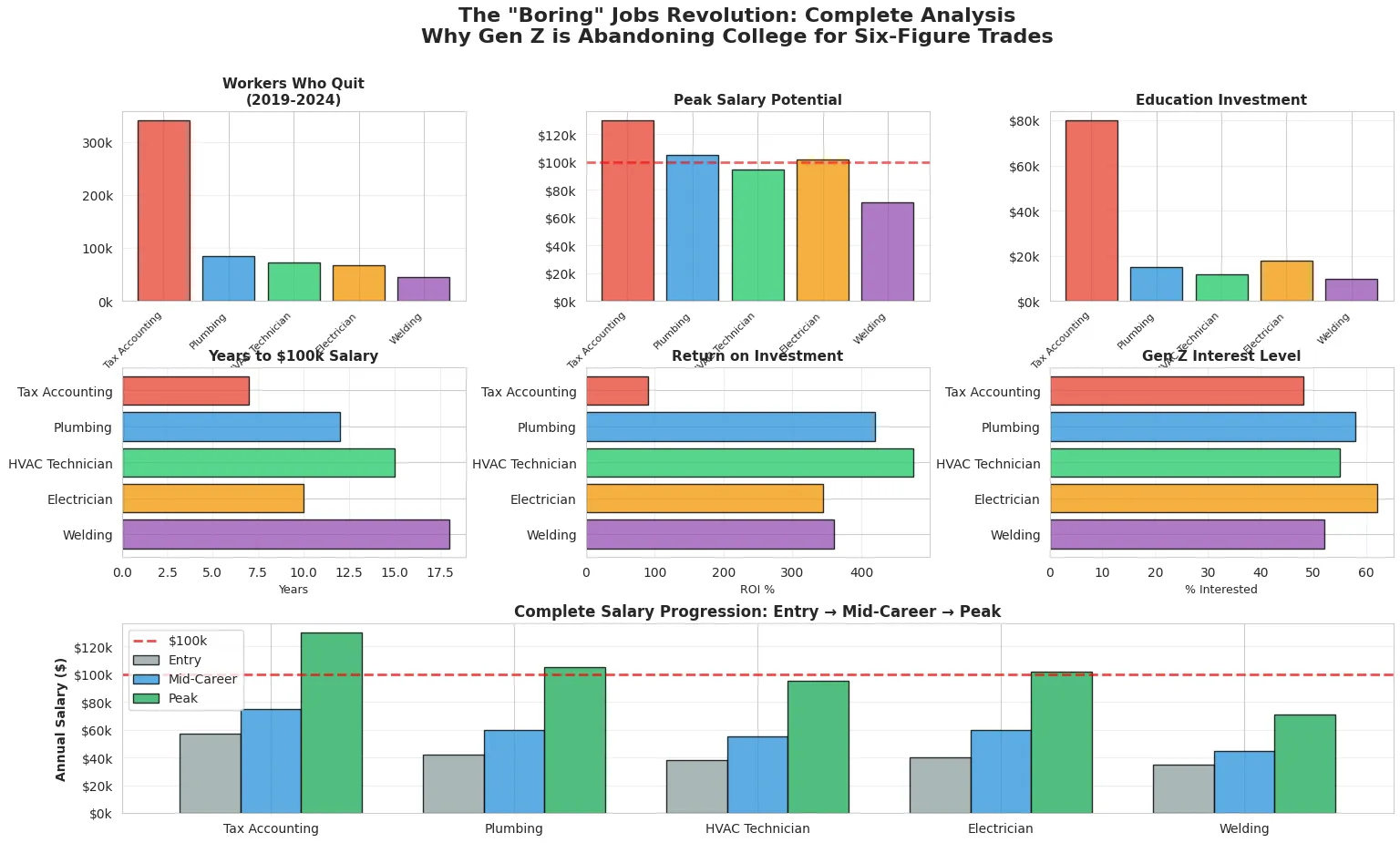

I analyzed the data on five “boring” careers using Livedocs (more on that in a bit), and honestly, the return on investment is kind of ridiculous.

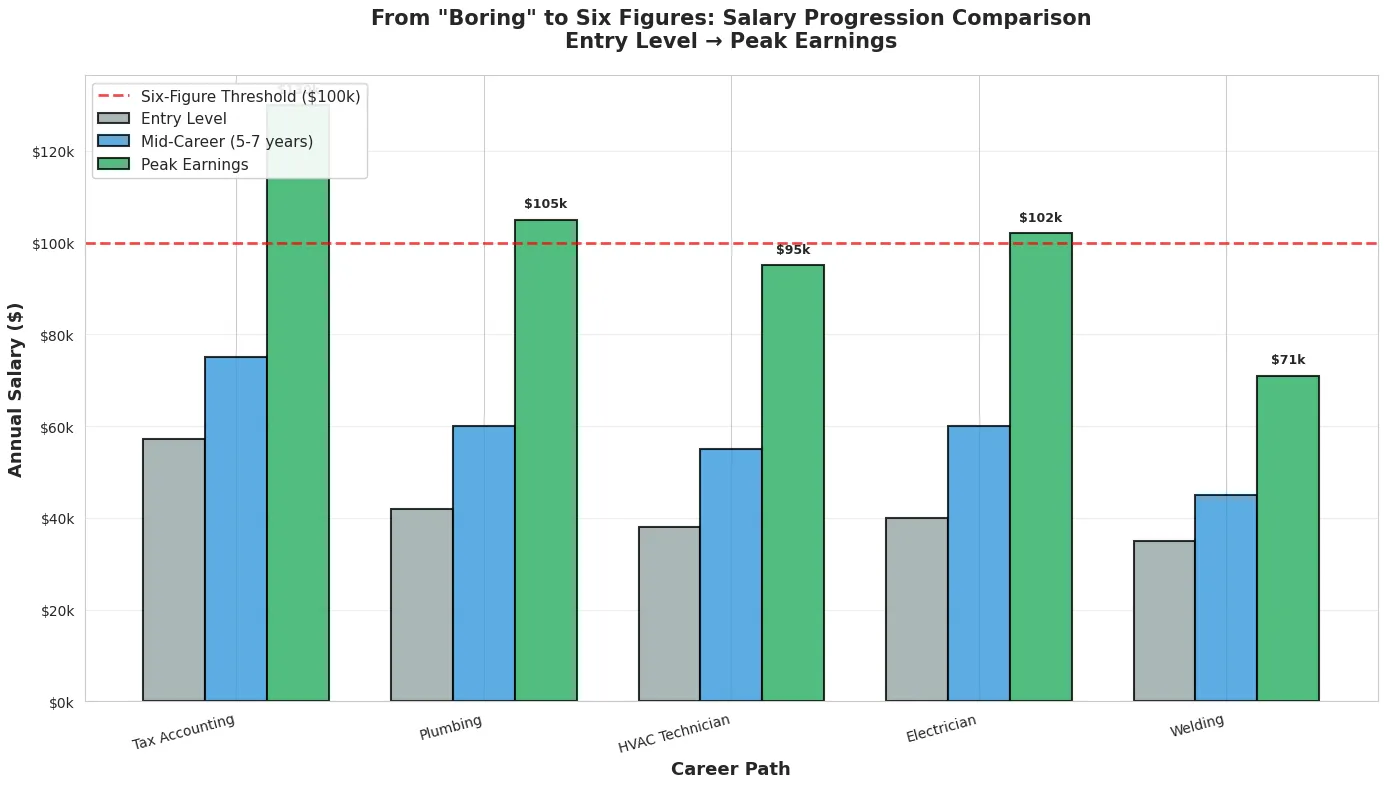

Tax Accounting:

- Entry salary: $57,250

- Mid-career: $75,000

- Peak earning: $130,000

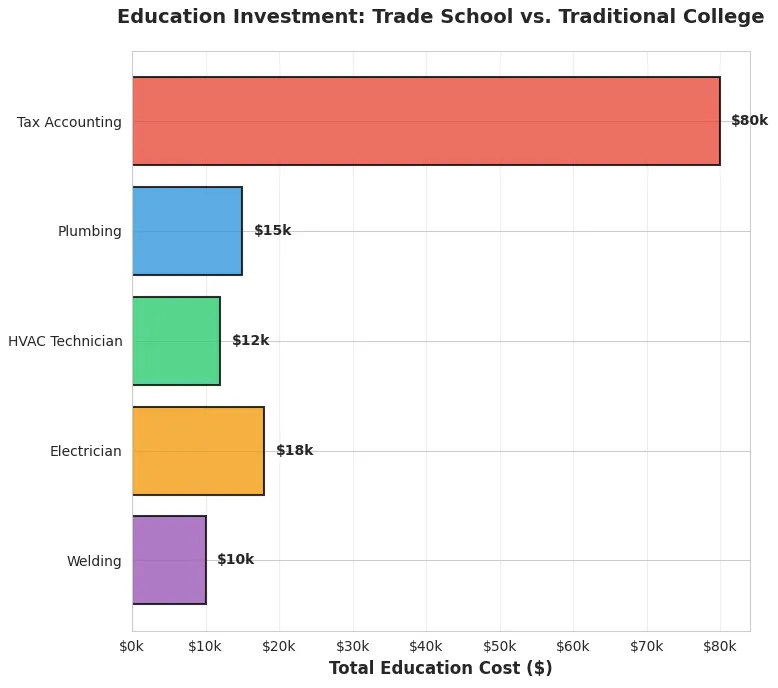

- Education duration: 48 months (4 years)

- 48% of Gen Z expressing interest

You’re looking at a six-figure salary without crippling student debt, because guess what? You can learn tax accounting at community college for a fraction of what a private university charges. And with 340,000 professionals having left the field, employers are desperate.

Electrician:

- Entry salary: $40,000

- Mid-career: $60,000

- Peak earning: $102,000

- Education duration: 24 months (2 years)

- 62% Gen Z interest (highest of all trades analyzed)

Two years of training. Six figures eventually. And 60% of current electricians are expected to retire in the next decade. Supply and demand, people. Economics 101.

Plumbing:

- Entry salary: $42,000

- Mid-career: $60,000

- Peak earning: $105,000

- Education duration: 18 months

- 58% Gen Z interest

Eighteen months. You could be earning forty grand in less than two years. Meanwhile, your college buddy is still taking prerequisites for their major they’ll probably change twice.

HVAC Technician:

- Entry salary: $38,000

- Mid-career: $55,000

- Peak earning: $95,000

- Education duration: 12 months (1 year!)

- 55% Gen Z interest

One year. Fifty-five thousand at mid-career. Ninety-five thousand at peak. And with 58% of HVAC techs retiring in the next decade, you’ll have your pick of jobs.

Welding:

- Entry salary: $35,000

- Mid-career: $45,000

- Peak earning: $71,000

- Education duration: 9 months

- 52% Gen Z interest

Okay, welding’s the outlier here with lower peak earnings, but nine months of training? You could literally start your career before your friends finish their first year of college.

The Math Everyone Ignored

Let’s do some quick calculations that your high school algebra teacher would be proud of.

Traditional four-year college:

- Average cost: $35,000-$50,000 per year

- Total cost: $140,000-$200,000

- Time to start earning: 4-6 years (including job search)

- Student debt: Crushing

- Years spent earning $0: 4+

Trade school electrician:

- Average cost: $8,000-$15,000 total

- Time to start earning: 2 years

- Student debt: Manageable or none

- Years spent earning $0: 2

- Bonus: You’re often earning while apprenticing

By the time your college friend finally starts their entry-level job at $50k with $150k in debt, you’ve already been working for two years, earning money, building experience, and maybe even starting your own business.

But wait, it gets better. Remember those retirement numbers? When 62% of electricians retire over the next decade, who do you think will name their own price? The 25-year-old with three years of experience or… literally nobody else because there aren’t enough electricians?

Why Did Everyone Abandon These Jobs?

The cultural shift happened gradually, then suddenly. Somewhere between the 1980s and 2000s, America decided that working with your hands was beneath people. That “real” success meant a corner office, not a toolbelt.

Parents pushed their kids toward college, any college, because that’s what the American Dream looked like on TV. Clean hands, business casual, air-conditioned offices. Never mind that most people hated their corporate jobs; at least they could say they went to college.

Millennials and boomers bought the narrative wholesale. Accounting became “boring.” Plumbing was for people who “couldn’t make it” in the real world. HVAC work was something you did if you “weren’t smart enough” for university.

The irony? Those “boring” accountants were making bank. Those “failed” plumbers were buying houses. Those “not smart enough” HVAC techs were building wealth while their college-educated peers drowned in student debt.

But Gen Z? Gen Z watched their parents and older siblings struggle. They saw the promised land of college degrees turn into service industry jobs with massive debt attached. They did the math.

And the math says: learn a skill, earn real money, skip the debt.

How Livedocs Makes This Analysis Possible

Quick sidebar because this matters: analyzing this career data wasn’t some gut-feeling guesswork. I pulled actual numbers, crunched real statistics, and built visualizations using Livedocs.

Why am I mentioning the platform? Because this kind of analysis, comparing education duration, salary trajectories, retirement projections, and Gen Z interest levels, requires actual data work. You need to aggregate information from multiple sources, calculate ROI, normalize salary data, and build charts that make sense of it all.

Livedocs pulls together workforce departure data, salary ranges, education requirements, and demographic interest in one place. I could write analysis alongside the code that generated it, create visualizations that tell the story, and share the whole thing as an interactive notebook.

For anyone doing career research, investment analysis, or really any work that combines data and narrative, it’s the difference between throwing numbers in a spreadsheet and actually understanding what they mean.

The Skills Gap Is Getting Worse

Here’s where this gets really interesting. The retirement wave isn’t hypothetical future stuff, it’s happening now.

75% of accountants retiring in the next decade isn’t spread evenly. Many are leaving right now. Same with electricians (60% retiring), plumbers (62%), and HVAC techs (58%). These aren’t projections based on wishful thinking; they’re demographic realities based on age distribution in these professions.

What happens when supply crashes and demand stays constant (or increases)? Prices go up. In this case, “prices” means salaries.

Entry-level electricians commanding $40,000 now? That’s going up. Mid-career plumbers at $60,000? Give it five years. The labor shortage is real, the work still needs doing, and employers will pay what the market demands.

Meanwhile, colleges are churning out liberal arts majors with no marketable skills and crushing debt. Supply and demand works both ways, friends.

But What About the Hard Work?

Right, let’s address the elephant in the room. These jobs involve actual physical work. You’ll get dirty. You’ll be tired at the end of the day. It’s not sitting in an office browsing Twitter (sorry, X) between Zoom calls.

But here’s the thing: hard work stops feeling hard when you’re getting paid properly. And there’s something deeply satisfying about fixing an actual problem, replacing a circuit, unclogging a drain, installing an HVAC system, compared to sitting in your fourth meeting of the day discussing the discussion you had yesterday.

Plus, physical work keeps you in shape. You don’t need a gym membership when your job is your workout. Try finding that benefit in corporate America where everyone’s back is shot from desk chairs.

And let’s be honest about “hard work” in the modern age. Is writing emails and attending meetings really easier than learning to wire a building? Both require skill. Both require training. One just pays better with less debt attached.

The Autonomy Factor

Here’s something the salary charts don’t show: these careers offer paths to business ownership that white-collar jobs simply don’t.

You can’t just “start your own law firm” fresh out of law school. You can’t “start your own hospital” after medical school. Corporate hierarchies are rigid, and climbing them takes decades.

But skilled trades? You can absolutely start your own plumbing company, electrical contracting business, or HVAC service after a few years of experience. And when 60% of your competition is retiring, that business might be very successful very quickly.

The tax accountant path? Same deal. Work for a firm for three years, learn the ropes, then hang your own shingle. Clients need tax help every year, and with hundreds of thousands of accountants having quit the profession, they’re not exactly swimming in options.

This is wealth-building, not just income-earning. Own your business, build equity, sell it eventually if you want. That’s how generational wealth gets created.

The College Debt Comparison That Hurts

Let me paint two scenarios because numbers in isolation don’t hit the same way.

Scenario A: Traditional College Route

- Age 18-22: College, accumulating $150,000 in debt

- Age 22-23: Job hunting, maybe working service industry

- Age 23: First “real job” at $45,000

- Age 30: Hopefully making $70,000, still paying off debt

- Total earned by 30: ~$400,000 (gross, before taxes and debt payments)

- Net worth at 30: Maybe $50,000 if lucky, possibly negative

Scenario B: Electrician Route

- Age 18-20: Trade school + apprenticeship, earning while learning

- Age 20: Licensed, earning $40,000

- Age 23: Three years experience, earning $50,000

- Age 30: Senior electrician or running own business, earning $80,000+

- Total earned by 30: ~$550,000 (gross)

- Net worth at 30: Potentially $100,000+, no debt

Oh, and Scenario B has been earning and saving for three years before Scenario A even starts their career. That’s compound interest working in your favor, not student loan interest working against you.

What About Job Security?

“But what if robots take these jobs?”

Okay, let’s think about this logically. AI can write articles (hi, I’m human, I promise). AI can analyze data. AI can probably do a lot of white-collar work.

But AI can’t crawl under your house to fix a pipe. Robots aren’t wiring buildings anytime soon. The physical, hands-on nature of these jobs makes them automation-resistant in ways that office work absolutely isn’t.

If anything, you should be more worried about your cushy office job getting replaced by ChatGPT than your plumbing business getting disrupted by robots.

Plus, these are essential services. People need electricity. They need water. They need heating and cooling. They need their taxes done (thanks, government complexity). These aren’t luxury services that disappear in recessions, they’re necessities.

Economic downturn? People still need their HVAC fixed. In fact, they’re more likely to repair than replace during tough times, which means more work for trades.

Why Gen Z Doesn’t Care About Status

The biggest barrier isn’t money or difficulty, it’s status. Boomers and millennials abandoned these careers because they cared deeply about what their neighbors thought. About being able to say “my child is a lawyer” instead of “my child is an electrician.”

But Gen Z grew up watching their parents work jobs they hated for companies that laid them off anyway. They watched “successful” people burn out. They saw the corporate ladder lead nowhere. And they decided status wasn’t worth being broke and miserable.

This generation values financial independence over impressive job titles. They value work-life balance over corner offices. They value skills that can’t be outsourced over credentials that everyone has.

When 93% of Gen Z graduates believe trades offer better economic security than traditional college, that’s not youthful naivety, that’s pattern recognition.

The Hidden Benefits Nobody Talks About

Beyond the salary and low debt, these careers offer benefits that office jobs increasingly don’t:

Schedule flexibility:

Own your own business? You set your hours. Even working for someone else, trades often offer flexibility that corporate jobs don’t.

Recession resistance:

Essential services don’t disappear when the economy tanks. Your services might even be in higher demand as people repair instead of replace.

Geographic freedom:

Plumbers are needed everywhere. Can’t outsource unclogging a drain to India. Can’t have an electrician Zoom in from the Philippines. Your skills work anywhere in the country.

Physical health:

Active work keeps you moving. No sitting disease. No office-chair back problems. Built-in exercise.

Immediate gratification:

Fixed the problem? Done. None of this “project-based work spanning quarters” nonsense. Real problems, real solutions, real satisfaction.

No corporate politics:

Harder to play office politics when you work alone or with a small crew. Your work speaks for itself.

What About Advancement?

“Okay, but I don’t want to be wiring houses at 50.”

Fair enough. Here’s the thing about these careers: the advancement path is clear and achievable.

- Years 1-3: Learn the trade, get licensed, build experience

- Years 3-7: Become a senior technician, train apprentices, maybe specialize

- Years 7-15: Start your own business, hire others, build a customer base

- Years 15+: Run multiple crews, focus on business management, semi-retire if you want

That’s not a fantasy. That’s an actual, achievable career trajectory. And at each stage, you’re earning more and building equity.

Compare that to corporate:

- Years 1-5: Entry level

- Years 5-10: Still entry level with better title

- Years 10-15: Maybe middle management

- Years 15+: Probably laid off in restructuring

The Real ROI Nobody Calculated

Return on investment isn’t just money in versus money out. It’s also:

- Time to profitability: How fast do you start earning?

- Debt burden: How much freedom do you lose servicing debt?

- Skill acquisition: What can you actually do?

- Business ownership potential: Can you build equity?

- Stress levels: Are you miserable?

- Life satisfaction: Do you hate Monday mornings?

On every single one of those metrics except possibly “prestige at dinner parties,” skilled trades win.

And honestly, if your self-worth depends on impressing people you barely know with your job title, that’s a therapy problem, not a career problem.

The Numbers Don’t Lie

Let me give you the cold, hard data one more time because this is the stuff that matters:

- 340,000 accountants quit in five years

- 62% of electricians retiring in next decade

- 60% of plumbers expected to retire

- 58% of HVAC techs aging out

- 55% of Gen Z considering trades

- 93% of Gen Z grads believe trades offer better security

- 23% jump in construction trade enrollment (2022-2023)

- 16% surge in overall vocational college enrollment (2023)

Those aren’t opinions. Those aren’t motivational speaker fluff. Those are real statistics showing a real shift in the labor market.

And Gen Z is positioning themselves to capitalize on it while everyone else is still pretending that $200,000 in student debt for a $50,000 job makes sense.

My Honest Take

Look, I’m not saying everyone should become a plumber. Some people genuinely love research, or teaching, or other careers that require traditional college.

But if you’re going to college “because that’s what you do,” or if you’re racking up debt for a degree you’re not passionate about, or if you’re working a corporate job you hate just because it seems “respectable”, it might be time to rethink things.

The “boring” jobs aren’t boring. They’re stable, well-paid, in-demand, and offer clear paths to business ownership and wealth building. They’re boring in the same way that making six figures without debt is boring. In the same way that owning your own business is boring. In the same way that being financially secure is boring.

Gen Z figured this out. They looked at the economic landscape, did the math, and made rational decisions. They’re not being entitled or lazy, they’re being pragmatic.

And in ten years, when they own their homes outright while their college-educated peers are still paying down student loans, it’ll be pretty clear who made the smart choice.

Final Thoughts

Your parents’ career advice was dead wrong. Not because they were trying to mislead you, but because they operated in a different economic reality.

In their time, college was affordable, white-collar jobs were stable, and pensions existed. In their time, avoiding “boring” trades made sense because corporate careers offered security. That world doesn’t exist anymore.

College costs ten times what it did. Corporate loyalty is dead. Pensions are extinct. The social contract broke, and nobody told your parents.

But Gen Z noticed. They did the math, looked at the opportunities, and realized that the “boring” jobs nobody wants are actually the smart play.

340,000 accountants quit. 62% of electricians are retiring. The labor shortage is real, the money is real, and the opportunity is real.

The only question is: are you going to keep following advice from a world that no longer exists, or are you going to follow the data?

Because the data says: skip the debt, learn a skill, earn real money.

To make your own analysis like this? Use Livedocs.

- 8x speed response

- Ask agent to find datasets for you

- Set system rules for agent

- Collaborate

- And more

Get started with Livedocs and build your first live notebook in minutes.

- 💬 If you have questions or feedback, please email directly at a[at]livedocs[dot]com

- 📣 Take Livedocs for a spin over at livedocs.com/start. Livedocs has a great free plan, with $10 per month of LLM usage on every plan

- 🤝 Say hello to the team on X and LinkedIn

Stay tuned for the next tutorial!

Data Sources: Bureau of Labor Statistics, National Center for Education Statistics, trade association workforce reports, vocational enrollment data (2022-2024). Analysis conducted using Livedocs platform combining workforce data, salary surveys, and demographic trends.

Methodology Note: Salary figures represent national averages and vary by location, specialization, and experience. ROI calculations based on typical education costs and time-to-employment data. Retirement projections based on age demographics within each profession as of 2025.

Ready to analyze your data?

Upload your CSV, spreadsheet, or connect to a database. Get charts, metrics, and clear explanations in minutes.

No signup required — start analyzing instantly