Silver Market Analysis 2025

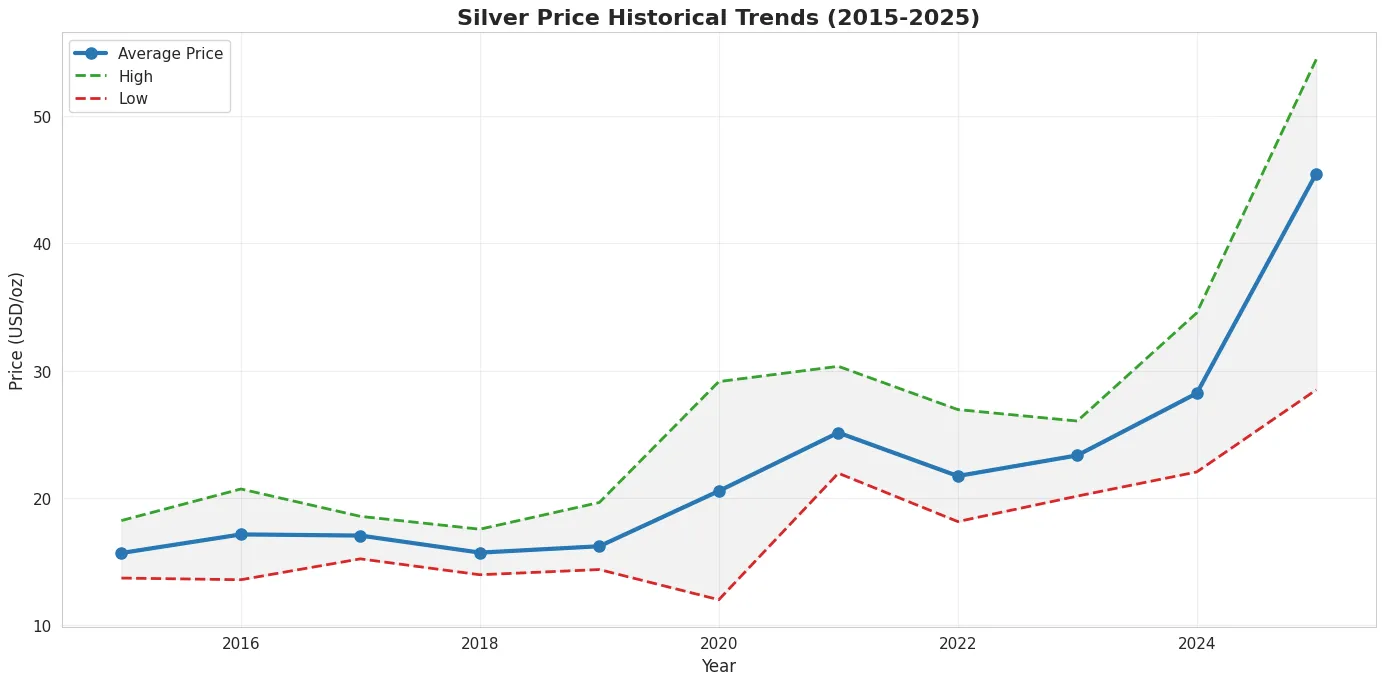

You know what’s fascinating about silver right now? It’s having its best run in decades, and most people are just, not paying attention. While everyone’s obsessing over Bitcoin hitting new highs or the latest tech stock drama, this ancient metal quietly surged over 80% in 2025, crossing $54 per ounce for the first time ever.

Understanding why silver’s doing what it’s doing isn’t simple. There’s industrial demand from solar panels, safe-haven buying from nervous investors, supply chain nightmares, geopolitical tensions, and macroeconomic trends all mixing together like some chaotic financial stew.

That’s exactly what makes a recent comprehensive analysis on Livedocs so compelling. Someone actually sat down and untangled this mess, building a complete picture of where silver’s been, where it is, and where it might be heading. Let me walk you through what we found.

And here we are using Livedocs Deep Research Agent to pull up 20+ resources and data across the internet to do the analysis.

You can access the notebook here, this is the link

Seven Years of Running on Empty

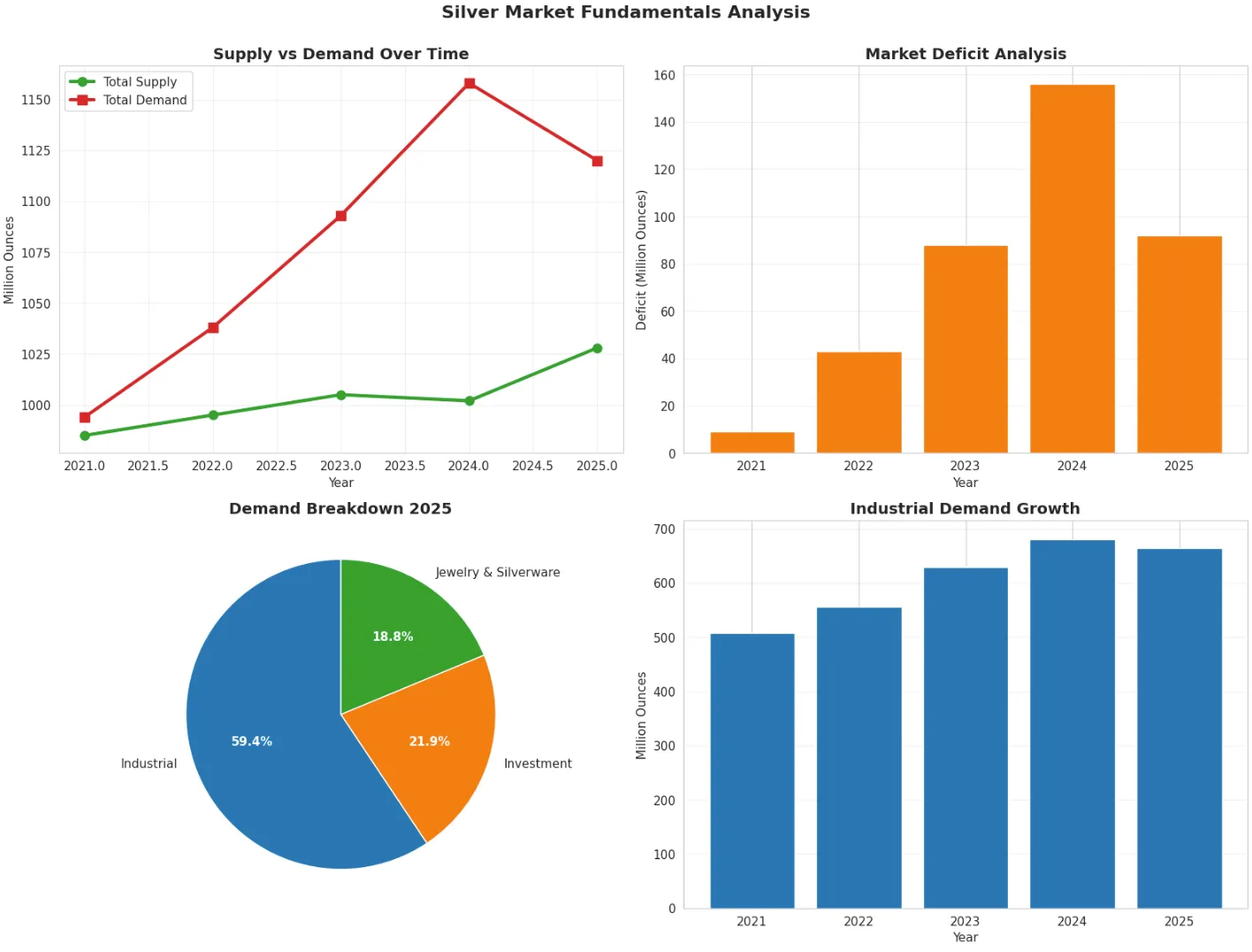

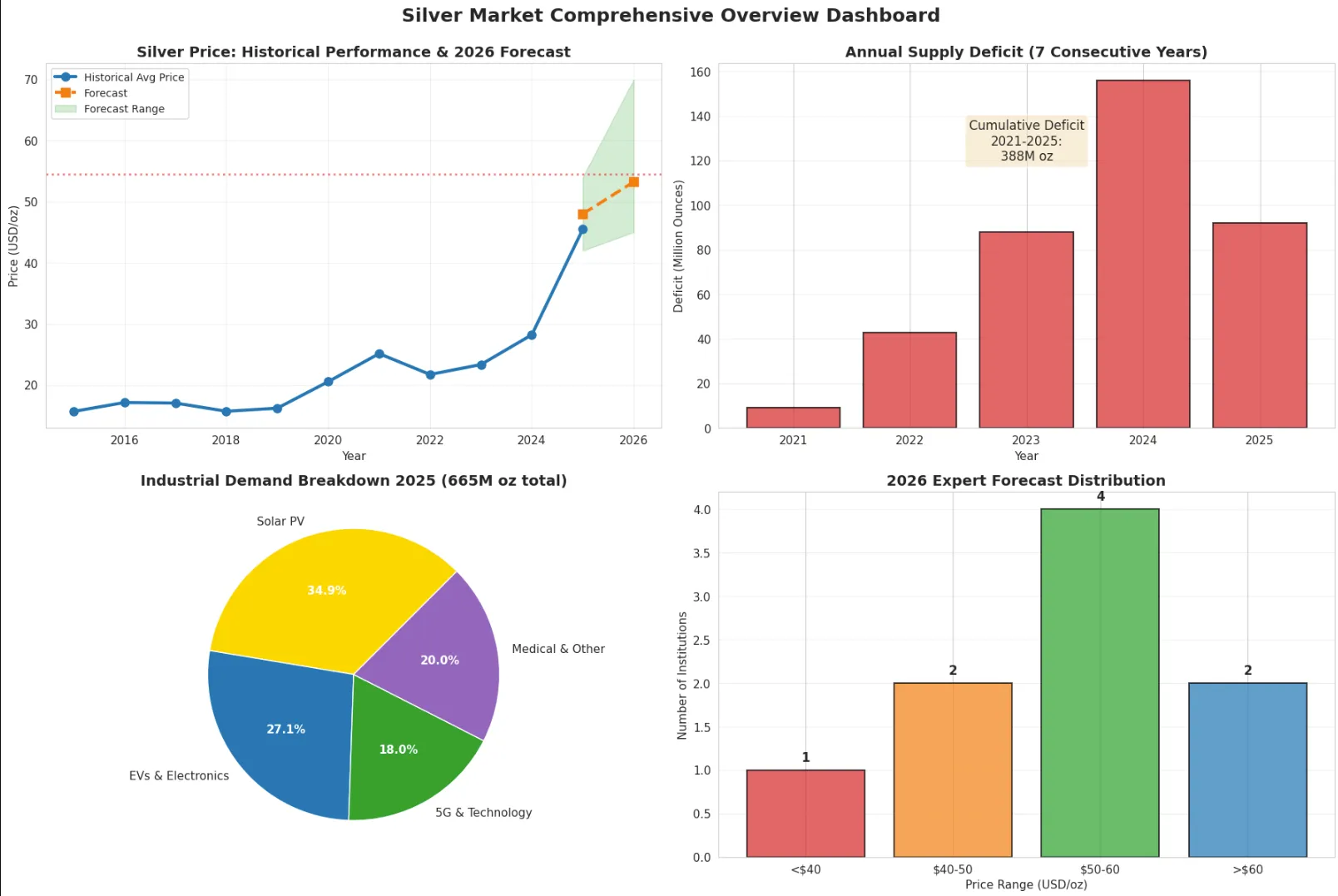

Let’s start with the elephant in the room: silver’s been in a structural deficit for seven consecutive years. Think about that for a second. Seven years where demand consistently outstripped supply. That’s not a blip or a temporary imbalance, that’s a fundamental shift in how this market works.

The numbers are pretty stark. We’re talking about 388 million ounces of cumulative deficit since 2021. To put that in perspective, that’s roughly the annual production of the world’s top three silver-producing countries combined. Above-ground inventories? They’ve been drained to what some analysts are calling “critically low levels.”

Mine production isn’t helping either. It’s basically flat. Unlike other commodities where high prices typically trigger a supply response (more exploration, new projects, increased output), silver’s different. Most silver about 70% comes as a byproduct of mining other metals like copper, lead, and zinc. So even when silver prices rally, miners can’t just magically produce more of it.

The Industrial Demand Nobody Talks About

Here’s where things get really interesting. We tend to think of silver as money—a store of value, an inflation hedge, that shiny stuff your grandparents kept in a drawer. But industrial demand now accounts for 59% of total consumption. That’s 665 million ounces annually going into actual things we use every day.

Solar photovoltaics alone consume 232 million ounces each year. That’s 19% of all silver demand, just for solar panels. And with countries around the world accelerating their renewable energy transitions, whether because of climate commitments or energy security concerns, that number’s only going up.

Electric vehicles need silver. 5G infrastructure needs silver. Advanced electronics, medical devices, water purification systems, they all need silver. Unlike many industrial applications where you can substitute cheaper materials, silver’s unique properties (highest electrical conductivity, thermal conductivity, and reflectivity of any metal) make it essentially irreplaceable for many cutting, edge technologies.

The analysis breaks this down beautifully: investment demand adds another 245 million ounces (22% of total), while jewelry and silverware account for smaller but still significant portions. When you map it all out, you realize this isn’t your grandfather’s precious metal market anymore.

The Macro Backdrop That Changes Everything

Now, let’s talk about the economic environment, because this is where the traditional “safe haven” narrative starts making sense again.

The Federal Reserve’s easing cycle kicked in during 2024-2025, with interest rates trending lower. That matters for silver, a lot. When real yields (nominal interest rates minus inflation) fall, the opportunity cost of holding non-yielding assets like precious metals decreases. Suddenly, that silver bar in your safe doesn’t look so silly compared to a Treasury bond yielding 2% while inflation runs at 3%.

US dollar weakness amplifies this effect. Silver, priced in dollars globally, becomes cheaper for international buyers when the greenback weakens. The analysis highlighted how this dynamic created ideal conditions throughout 2025.

But wait, there’s more. (I promise that’s not an infomercial pitch.) Geopolitical tensions—trade wars, Middle East conflicts, political uncertainties, drove investors toward tangible assets. Gold got most of the headlines, but silver quietly benefited from the same forces while offering better value and industrial utility.

When the Big Banks Actually Agree

One thing that caught my eye? The consensus among major financial institutions. When Bank of America, UBS, Citigroup, and HSBC all raise their silver forecasts within months of each other, you pay attention.

Bank of America went to $65 per ounce for their 2026 target. UBS and Citigroup both called for $55. HSBC projected $58. These aren’t fringe analysts throwing out wild predictions for clicks—these are conservative institutions with massive research departments and reputations to protect.

The analysis synthesized these expert opinions alongside the fundamental data, creating a comprehensive view that’s hard to dismiss. It’s one thing when a Reddit forum goes bullish on silver. It’s another when the entire traditional finance establishment starts upgrading forecasts.

The Risks Nobody Wants to Discuss

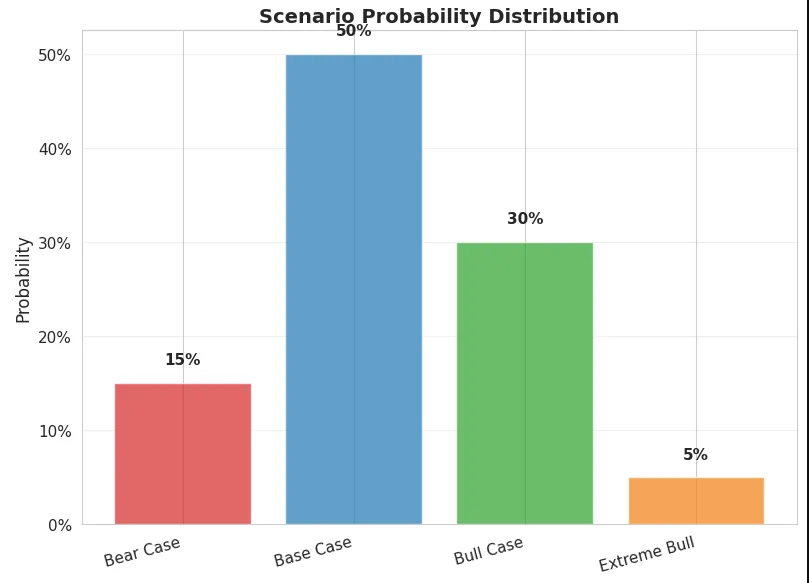

Of course, not everything’s sunshine and rainbows. Any honest analysis has to grapple with the downside scenarios, and this notebook didn’t shy away from them.

Demand destruction is real. If silver prices spike too high, too fast, industrial users start looking harder at substitution options. That LED lighting application? Maybe there’s a way to use less silver. That solar panel design? Perhaps we can optimize the silver content down by 10%.

Supply could also respond eventually. New mines might come online. Recycling rates could increase. Secondary production might pick up. While these things take time, they’re not impossible.

Then there’s the macro wildcard: what if central banks pivot back to aggressive tightening? What if inflation collapses? What if geopolitical tensions ease and safe-haven demand evaporates? The analysis acknowledged these scenarios as legitimate risks, assigning probability ranges to various outcomes.

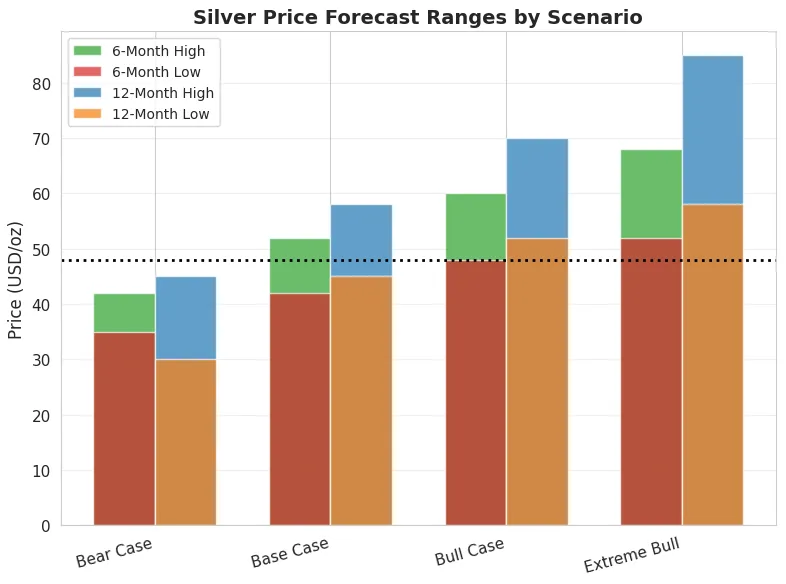

The bear case puts silver potentially dropping to $38-42 in a scenario where several headwinds converge. That’s not catastrophic, but it’s a meaningful decline from current levels.

Price Targets That Actually Make Sense

Here’s what I appreciated: instead of just throwing out a single number and calling it a day, the analysis provided a realistic framework with multiple scenarios.

Q1 2026:

Expected range of $48-56 per ounce, with potential for higher spikes if supply disruptions occur or safe-haven demand accelerates.

Q2 2026:

Projected consolidation around $52-58 as markets digest first-quarter moves and assess industrial demand trends.

Q3-Q4 2026:

Base case targets $55-62, with upside scenarios pushing toward $65+ if structural deficits worsen and investment inflows continue.

The reasoning behind these targets wasn’t just “line go up”, it was grounded in specific catalysts, seasonal patterns, supply-demand dynamics, and correlation with broader macro trends. You could actually trace the logic from fundamental drivers to price projections.

How to Actually Play This

The notebook didn’t just analyze the market, it provided practical guidance for positioning. Recommended allocation? 5-15% of portfolio, which seems reasonable for a volatile asset class. Best vehicles varied by investor profile:

Physical silver for true believers wanting direct exposure SLV or PSLV for liquidity and convenience Mining equities (AG, PAAS, HL) for leveraged exposure Silver futures for traders with risk tolerance

The strategy section broke down specific trading ranges, tactical approaches for different timeframes, and common mistakes to avoid. Things like: don’t chase rallies beyond key resistance. Don’t ignore technical signals just because fundamentals look strong. Don’t forget about tax implications. This level of detail transformed the analysis from interesting market commentary into something actually actionable.

Why This Matters Beyond Silver

Honestly, whether you care about silver or not (and maybe you shouldn’t, not every investor needs precious metals exposure), this analysis demonstrates something important about modern financial research.

We’re moving past the era where only institutional investors with Bloomberg terminals and six-figure research budgets could conduct this kind of comprehensive analysis. The democratization of financial data, combined with powerful analytical tools, means individual investors can now produce institutional-quality research from their laptop.

That’s actually pretty remarkable when you think about it.

Enter Livedocs: Making Complex Analysis Accessible

So here’s where things get interesting from a tools perspective. How did someone create such a comprehensive, multi-layered analysis that synthesizes dozens of data sources, expert forecasts, and complex scenarios?

The answer: Livedocs, an AI-powered collaborative workspace that’s fundamentally changing how people approach serious data work. Traditional data analysis usually means one of two paths. Either you’re a power user juggling SQL databases, Python scripts, Jupyter notebooks, visualization libraries, and probably swearing at error messages, or you’re stuck with oversimplified “text-to-SQL” tools that break the moment you ask anything remotely complex.

Livedocs lives in a different space entirely. It combines the analytical power of notebooks with the simplicity of modern app builders, wrapped in an AI agent that actually understands what you’re trying to accomplish.

Final Thoughts

Whether silver hits $65 next year or pulls back to $40, the analytical approach demonstrated in this Livedocs notebook represents something valuable: systematic, comprehensive research using modern tools.

We’re in an era where individual analysts, small teams, and innovative firms can compete with massive institutions in terms of research quality. The playing field isn’t perfectly level, institutional investors still have advantages in data access, expertise, and capital, but it’s more level than it’s ever been.

Tools like Livedocs accelerate this trend by removing technical barriers between insight and analysis. When a healthcare analyst can explore hospital data through conversation, or a market researcher can build complex forecasting models without writing a hundred lines of code, or a growth marketer can merge behavioral data with campaign metrics in real time that’s when interesting things start happening.

To make your own analysis like this? Use Livedocs.

- 8x speed response

- Ask agent to find datasets for you

- Set system rules for agent

- Collaborate

- And more

Get started with Livedocs and build your first live notebook in minutes.

- 💬 If you have questions or feedback, please email directly at a[at]livedocs[dot]com

- 📣 Take Livedocs for a spin over at livedocs.com/start. Livedocs has a great free plan, with $10 per month of LLM usage on every plan

- 🤝 Say hello to the team on X and LinkedIn

Stay tuned for the next tutorial!

Disclaimer: This article discusses a specific market analysis for educational purposes and does not constitute financial advice. Silver prices are highly volatile, and all investment decisions should be made after conducting your own research and consulting with qualified financial advisors.

Ready to analyze your data?

Upload your CSV, spreadsheet, or connect to a database. Get charts, metrics, and clear explanations in minutes.

No signup required — start analyzing instantly